Salary, minimum wage and payslips in the Netherlands

Your hard-earned euros have arrived in your Dutch bank account after you secured the job, completed the paperwork, and put in the necessary work hours. Check your payslip now to see whether there are any additional good advantages, such as vacation time, a pension, or maybe supplementary benefits. However, Dutch payslips may be a real problem.

Why? Your Dutch pay stub is jam-packed with cryptic jargon, figures, and lengthy Dutch terms that even native speakers find frightening.

Understanding how your income is determined, how much tax you are paying, and how to interpret your payslip are often difficult concepts to grasp when beginning a new job in the Netherlands. You might also ponder whether you are being paid fairly. But don't worry; here's everything you need to understand about your Dutch payslip and how to read it correctly.

In order to better understand how salaries are taxed, what income you may anticipate (based on your expertise and industry), and what the minimum wage in the Netherlands is, we've included some general information below.

NET income and GROSS wage in the Netherlands

The distinction between your gross and net compensation is among the most crucial aspects of your Dutch salary to comprehend.

Gross salary

Your gross salary, also known as your bruto salary, is the sum of your pay before any deductions for taxes and other expenses.

Net salary

After income tax, social security payments, and pension contributions have been subtracted, your salary is referred to as your net income. The amount that is placed into your bank account each month is your net pay. Your employer will nearly always use the gross monthly amount when talking about your pay. There is a significant discrepancy between the two amounts, so make sure to verify the net amount.

How to figure out your net Dutch salary

For instance, if your gross monthly income is 2.500 euros (or 27.778 euros per year with the 8% holiday allowance), your net monthly income will be about 2.000 euros after taxes and social security contributions. Calculate your salary to obtain a sense of your net monthly income.

You can use this calculator HERE

Holiday pay, bonuses, and compensation packages

You will get a holiday allowance in May that is equal to 8% of your yearly income, or around one month's pay, in addition to your regular monthly compensation. This is to pay for your summer vacation-related costs.

On a monthly, quarterly, or yearly basis, certain companies may also provide performance-based incentives. A business automobile, a cell phone, or the payment of your monthly transportation expenses are examples of additional perks.

Foreign recruits of highly talented workers sometimes receive even more alluring compensation packages that cover relocation costs, initial housing costs for a brief stay, and (occasionally) the costs of sending their kids to an international school.

Your total yearly income is equal to your monthly wage, holiday allowance, and any bonuses or benefits.

How to read your Dutch payslip

Every time an employee is paid in the Netherlands, their employer gives them a payslip known as a "loonstrook." Dutch payslips' payment breakdowns might be challenging to understand.

Payslip top section: personal details

Periode - the relevant time period (week or month)

Personeelsnummer - employee number

Salaris / uurloon - gross salary (pre-tax)

Bijz. tarief / heffingskorting (ja) - tax rate (percentage) / general tax credit (yes)

Verzekerd voor WW, WiA, ZW, Zvw - social security you are covered for / contribute to

Datum in dienst - date you entered employment

Burgerservicenummer (BSN) - your Dutch social security number

Functieomschrijving - job description

Payslip middle section: salary breakdown

Omschrijving - description

(Normale) gewerkt uren - (normal) hours worked

Salaris - gross salary based on hours worked

Brutoloon - gross salary before tax and other deductions

Loonheffing - the amount deduced as prepaid tax and as social security contributions

Sociale verzekeringen (SV) - social security contributions

Reiskostenvergoeding - refunds such as transport costs

Nettoloon or Totalen - net salary after tax, deductions and refunds. This amount appears at the bottom of your payslip and is the final amount that is deposited into your bank account.

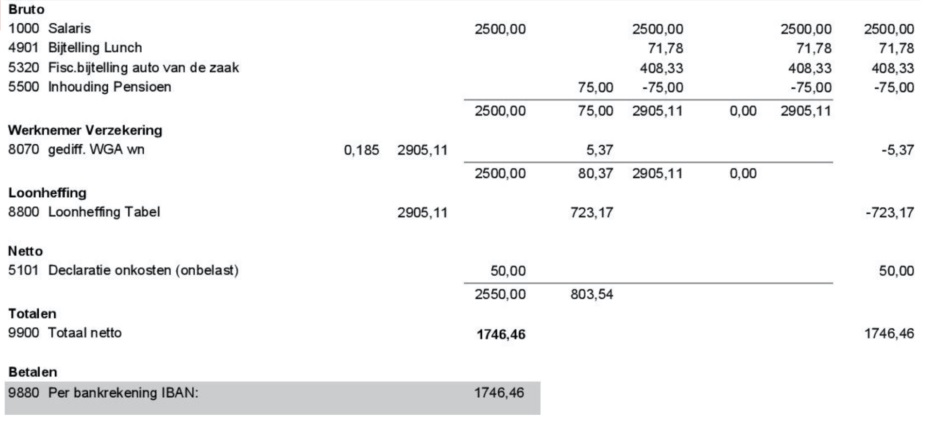

Example:

Payslip bottom section: holiday hours

(Opgebouwd) vakantiegeld - (accumulated) holiday leave (in hours)

Social premiums on your payslip

Social Security contributions may cover:

AOW (Algemene Ouderdomswet) / OP-premie - pension contribution

AP-premie - disability pension

ANW (Algemene nabestaandenwet) - widow benefit contribution

AWBZ - special health care needs contribution

WAO (Wet op de arbeidsongeschiktheidsverzekering) / WIA (Wet werk en inkomen naar arbeidsvermogen) - benefits for inability to work due to sickness

WW (Werkloosheidswet) - unemployment benefit

ZW or Zvw (Zorgverzekeringswet) - paid sick leave

The Netherlands' national average income

The typical gross monthly salary for a person working in the Netherlands in 2023 will be 2.994 euros, according to the Centraal Planbureau (CPB). Age, industry, professional experience, and hours worked all have an impact on compensation, which might differ significantly from the median wage. In the tables below, we examine a few of these elements.

Average salary

| Age group | Annual income (gross) |

| 15 - 25 years | 10.600 euros |

| 25 - 45 years | 36.400 euros |

| 45 - 65 years | 42.400 euros |

| 65 years+ | 24.900 euros |

Minimum wage in the Netherlands 2023

The monthly minimum wage paid to workers in the Netherlands who are at least aged 21 years has increased from 1 July 2023.

Age | Per month | Per week | Per day |

|---|---|---|---|

| 21 year and older | € 1.995,00 | € 460,40 | € 92,08 |

| 20 year | € 1.596,00 | € 368,30 | € 73,66 |

| 19 year | € 1.197,00 | € 276,25 | € 55,25 |

| 18 year | € 997,50 | € 230,20 | € 46,04 |

| 17 year | € 788,05 | € 181,85 | € 36,37 |

| 16 year | € 688,30 | € 158,85 | € 31,77 |

| 15 year | € 598,50 | € 138,10 | € 27,62 |